Welcome to Prosperity Partners Wealth Management

At Prosperity Partners Wealth Management, our job is to help you maintain your lifestyle, preserve your wealth, and create your legacy for today, tomorrow and years to come. Whether you are making plans or going through a major life transition, you have worked hard preparing for your financial future. The question is, are you really ready for what may lie ahead? The risks are too great, and time is too short to financially go it on your own.

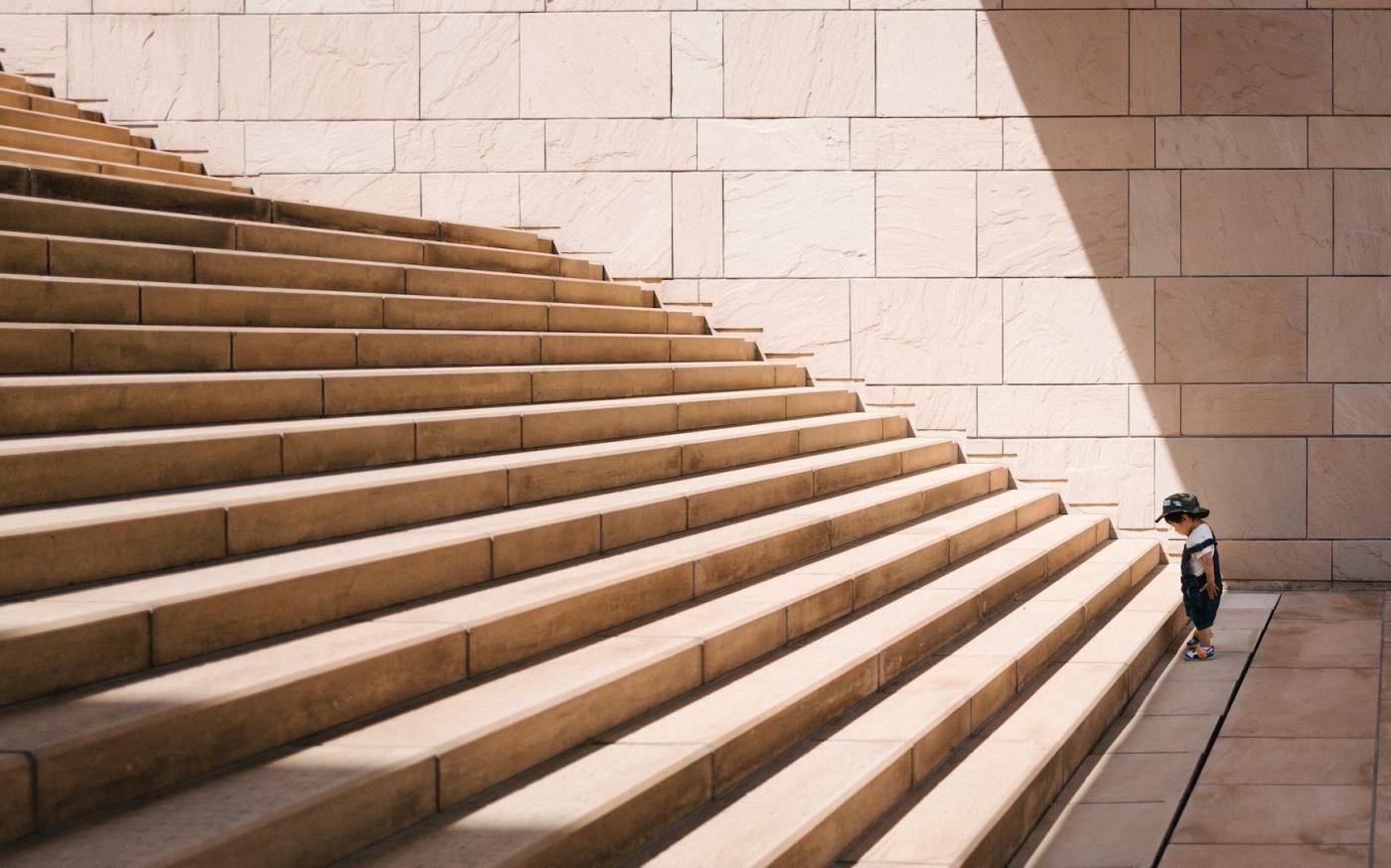

Now is the time to let us help you love your life, leave your legacy, and feel confident about the next steps on your path.

Call or e-mail us today for information on how we can help you live, love, and leave a legacy.

Ali Swofford, PhD, CLU, ChFC - Wesley N. Price, CFP® - Craig Hammer, CF2®, RICP®, Andrea Carpenter, CF2®, ChFC, CLU

Prosperity Partners Wealth Management specializes in independent comprehensive planning and wealth management for clients who would rather spend time living their bucket list, having confidence that the partners have their backs through their bucket plan. The dynamic of the partners, both male and female, combined with over ninety years of financial wisdom and experience with risk assessment and interactive planning software technologies, helps ease clients' concerns such as running out of money, paying too much in taxes and potentially going broke in a nursing home.

How can we help?

Ready to get started? Book a meeting with one of our advisors to learn more about how we can help you reach your retirement goals.